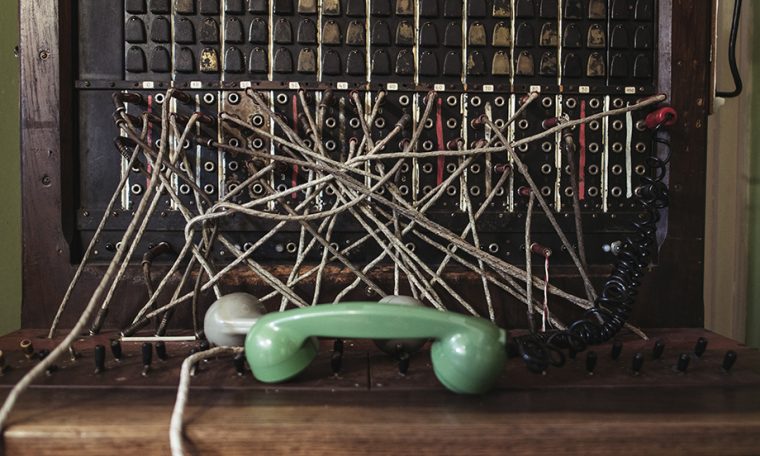

Security of payment has always been a vexed issue, for construction principals and for contractors alike. Legislative intervention in Queensland is now in place, and it has become clear that the extent of the intervention is much greater than clients and builders might have expected. Instead of being limited to payment disputes concerning traditional building projects, the laws attach to contracts for a wide range of goods and services, such as the installation of communication systems as well as the provision of architectural services.

Now, the Queensland Court of Appeal has clarified that the Building and Construction Industry Payments Act 2004 (Qld) (known as “BCIPA”) also applies to construction work on mining leases. As a result, many mining services activities taking place on mining leases will be captured by BCIPA’s mandatory payment claim system. This will have far-reaching impacts for mining and petroleum services companies.

Extraction sites are construction sites

In July 2013 the Supreme Court of Queensland ruled that construction work undertaken on a mining lease was not covered by BCIPA.(1) The Supreme Court’s reasoning was that the definition of “land” did not include land subject to a mining lease, and by connection would also not include any other natural resources lease or tenement, such as a petroleum tenement or mineral exploration lease. On the basis of that ruling, construction contracts on mining and petroleum leases were thought to be free from the limitations, timeframes and strict requirements of BCIPA.

But in December the Queensland Court of Appeal overturned the Supreme Court’s decision, ruling that “land” is “land”, and that the existence of a mining lease does not change or alter the character of land.(2)

Accordingly, BCIPA applies to all construction work contracts on land covered by mining leases. And, by reasonable analogy, we can surmise that BCIPA will also apply to the same kind of contracts in relation to land covered by a petroleum or other mineral lease. Contracts for mining and petroleum construction work – construction work is broadly defined – or for supplying related goods and services – this is even more broadly defined – will be covered by BCIPA.

The scope of activities that are covered by BCIPA is extensive, encompassing a variety of works and goods and services supply contracts. Parties cannot contract out of BCIPA. Failure to comply with BCIPA may result in costly dispute resolution; court action; suspension of construction work; a contract principal being required to pay interest; and a contractor missing out on payments.

Contractors and contract principals should examine whether their mining and petroleum services contracts include construction work or related goods and services. And remember – construction work includes more than what one might naturally consider to be “construction”.

Construction means more than just building work

BCIPA applies to all construction work and all related goods and services. It defines construction work as including:

- the construction, alteration, repair, restoration, maintenance, extension, demolition or dismantling of buildings or structures, permanent or not, including walls, roadwork, power lines, telecommunication apparatus, railways, waterways, pipelines, reservoirs, water mains, wells, sewers, plant and drainage; and

- the installation in any building, structure or works of fittings including heating, lighting, air-conditioning, ventilation, power supply, drainage, sanitation, water supply, fire protection, security and communications systems.

This extends well beyond the building of a structure. For example,construction work includes deconstruction work. Construction work under BCIPA extends to any separate operation that forms an integral part of construction work, or is part of the preparation or completion of construction work. This includes:

- site clearance, earthmoving, excavation, tunnelling and boring;

- the laying of foundations;

- the erection, maintenance or dismantling of scaffolding;

- the prefabrication of components of a building, structure or works, whether carried out on-site or off-site;

- site restoration, landscaping;

- the provision of roadways and access; and

- the testing of soils and materials.

Construction work even extends to cover the cleaning, painting or decorating of the internal or external surfaces of any building, structure or works, when carried out in the course of their construction, alteration, repair, restoration, maintenance or extension.

BCIPA’s application to contracts for related goods and services for construction work includes:

- materials and components to form part of any building or structure;

- work arising from construction work;

- plant or materials;

- the provision of labour;

- architectural, landscape, design, surveying and quantity surveying services;

- building, engineering, interior or exterior decoration; and

- soil testing.

There are some limits to BCIPA’s reach. For example, construction work does not currently include the drilling for, or extraction of, oil, natural gas or minerals. Tunnelling or boring, or constructing underground works, for those activities are not covered.

The wide reach of BCIPA is important. Anti-avoidance provisions prohibit attempts to contract-out of BCIPA. If BCIPA applies to a contract, the parties cannot agree that it does not.

Wear a legal hard-hat when it comes to BCIPA compliance

It is vital for contractors and contract principals to understand their rights and obligations under BCIPA.

BCIPA creates rights of payment for contractors carrying out construction work, or supplying related goods or services, in Queensland under a construction contract. The BCIPA regime intends to ensure that contractors are able to recover progress payments that are owed to them. It specifies strict and short payment time-frames that must be adhered to. Once a payment claim has been made under BCIPA, unpaid contractors may attempt to resolve disputes via adjudication and court action. They may suspend works, if certain conditions are met.

Below, we have examined the relative position of contractors and contract principals under BCIPA. For both, strategy and diligence is key.

Contractors need to comply with BCIPA to take advantage of it

BCIPA benefits and protects contractors by providing a framework for the recovery of progress payments from contract principals. The BCIPA framework for recovery is likely to be far superior to the rights and procedures under mining or petroleum services contracts. Contractors have greater certainty that payments will be made on time, or within an expedited time.

The steps required to claim payment entitlements should be followed by contractors. Particular attention needs to be had to deadlines, and we would recommend that specific employees be given the task and the responsibility of monitoring BCIPA obligations, all payments and non-payments issued by the contract principal. Failure to meet deadlines may reduce a contractor’s entitlements and the effectiveness of the protections provided by BCIPA. Good contract administration is vital so that contractors can enjoy the best possible protection.

The initial process under BCIPA for a contractor that has carried out construction work, or supplied related goods and services, is:

- when a progress claim or lump sum payment falls due – or is overdue – the contractor must serve a valid payment claim on the contract principal;

- to be valid the payment claim must fully comply with BCIPA;

- within 10 days, the contract principal must either respond by paying the amount claimed or by serving the contractor with a valid payment schedule disputing the amount claimed;

- if the contract principal does not pay, then the contractor may dispute the payment schedule through adjudication – the decision of the adjudicator is binding on the parties; and

- the contractor may have other options for enforcing the payment claim, such as issuing court proceedings for a judgment debt, suspending construction work or the supply of goods and services and/or claiming interest on overdue payments – which way to proceed comes down to strategy.

If the contractor complies with the necessary steps under BCIPA then the contract principal cannot take legal action against the contractor for suspending work. Non-compliance with BCIPA will invalidate its intended protections.

Onerous contracts are out - but contract principals can still manage unmeritorious claims

BCIPA has considerably limited the grounds on which contract principals can dispute payment claims. The contractual flexibilities that principals have traditionally enjoyed cannot be relied upon. Prior to BCIPA, construction contracts often included provisions allowing the contract principal to withhold payments until the contract principal had received payment from a principal “higher up the chain”. These provisions were known as trickle down or paid when paid clauses, and they allowed a contract principal to protect its cash flow.

Under BCIPA, clauses allowing for payment delays are highly restricted. Generally, they will be unenforceable in the face of a payment claim that complies with BCIPA. Nonetheless construction contracts can still be prepared in a way that allows some payment flexibility, while still complying with BCIPA. Good contract administration and an understanding of all rights and responsibilities under BCIPA is as essential for contract principals as it is for contractors.

If a contractor’s BCIPA claim goes to court, the contract principal may not raise a counterclaim against the contractor. The principal may only use technical arguments in its defence – such as whether the payment claim was issued in accordance with BCIPA. In this respect, it is in the best interests of the contract principal to comply with the BCIPA procedures so as to avoid going to court or, if it finds itself in court, to win.

Failing to comply with BCIPA could be a costly mistake

The recent decision of the Queensland Court of Appeal(3) has confirmed that contracts for a large number of mining and petroleum services will be covered by BCIPA. The reality is that many pre-existing contracts and contract administration processes just do not comply with BCIPA.

There is no excuse for being caught unprepared. Neglecting or not complying with BCIPA obligations could expose construction contractors to significant costs and potential liabilities beyond the value of the original construction contract. Failing to comply with BCIPA may lead to a suspension of construction work. Principals can be required to pay interest on overdue payments. Cash flow of contractors will be affected by missed payments. Serious failures can result in costly dispute resolution.

In short – properly applying BCIPA will give you a better chance of staying on the right side of the law, and on the right side of the ledger.

For more information, please contact Gerowyn Schuster, Senior Lawyer at Moulis Legal on (07) 3367 6900 or email gerowyn.schuster@moulislegal.com

(1) Agripower Australia Ltd v J & D Rigging Pty Ltd & Ors [2013] QSC 164

(2) J & D Rigging Pty Ltd v Agripower Australia Ltd & Ors [2013] QCA 406

(3) J & D Rigging Pty Ltd v Agripower Australia Ltd & Ors [2013] QCA 406

This memo presents an overview and commentary of the subject matter. It is not provided in the context of a solicitor-client relationship and no duty of care is assumed or accepted. It does not constitute legal advice.

© Moulis Legal 2014