The ability of foreign exporters and local importers to compete in Australian markets will be further compromised if and when new anti-dumping “tilts” in favour of local producers become law. In a move that will be likely to cause concern to Australia’s trading partners, proposals were tabled in Federal Parliament here in Canberra on 13 September 2017 to allow the government to fix prices for imported products in the Australian market at higher levels than the prices in the home market from which they were exported.

Presently, an exporter whose products are subject to dumping duties can ask for a review of those duties, based on contemporary cost and price data. At the conclusion of such a review, the exporter should expect to have the duties adjusted to meet its current circumstances. Dumping duty is intended to equalise the price of a product exported to Australia with its higher home market price, and not to penalise exporters and importers, or protect domestic industries against products that are not dumped.

But the proposed new laws allow the relevant Minister, on the advice of the Anti-Dumping Commission, to decide that dumping duties should continue to be paid by importers in higher amounts than contemporary costs and prices justify. The ability to continue to impose and collect dumping duties at high rates will give the Minister an unprecedented price-fixing power over imported products, to the extent that foreign exporters and their Australian importers may be unable to compete in Australian markets.

In this Trade Law Bulletin, Moulis Legal’s Daniel Moulis explains the “devil in the detail” of the proposed new laws, compares them against the benchmarks set out in the World Trade Organisation’s Anti-Dumping Agreement, and interprets what they say about current Australian trade policy.

What’s dumping and, more to the point, what’s anti-dumping?

Dumping occurs if an exporter sells a product to Australian importers at prices that are less than the product’s home market price, and by reason of that the Australian industry producing the same product is materially injured – i.e. caused significant financial damage. It’s a kind of economic tort. The anti-dumping part is what the Australian Government can do about it.

Dumping duty on products found to have been dumped is payable by importers at the border in accordance with a “method” prescribed by the Minister. The preponderant method has been the “combination method”, which is the total of two amounts:

- the percentage amount of the actual export price of the imported products, being the same percentage of the dumping by the exporter detected in the investigation that led to the imposition of the duties;1 and

- the amount by which the actual export price of the imported products is less than the average export price of the same products as were exported by the exporter in the period covered by the prior investigation.

Let’s use an example. In dumping parlance, the home market price is called the normal value. The export price is called… the export price. If the normal value in an investigation is found to have been $103, and the export price is found to have been $100, a dumping margin of 3% would be worked out. This is the $3 by which the export price was less than the normal value, expressed as a percentage of the export price.

The way in which the dumping duty would be calculated and collected on any future exports from the exporter concerned – after the investigation, and once dumping duties had officially been imposed – can be explained by assuming an actual export price of $95. The two amounts of duty that we have referred to above would be worked out like this:

- 3% of $100, being the average export price in the prior investigation, which is $3;2 and

- $100 minus $95, being the amount by which the actual export price is less than the average export price in the prior investigation, which is $5.

The dumping duty payable by the importer would therefore be $8.

Types of dumping duty expanded in 2013

In 2013, the Australian Government gave itself and its investigating authorities greater “flexibility” in the collection of dumping duties. The rules were shifted from the Act itself into regulations, and new collection methods were prescribed. The method already being used, the “combination method” as explained above, was retained. As well, the Minister was given new discretions to use different methods that included collecting dumping duty:

- only in the percentage margin of dumping as applied to the actual export price – thus, using the actual export price of $95 as per our example, 3% of that price, being $2.85, would be collected, and nothing more (“the ad valorem method”); and

- only in the amount that the actual export price was less than the normal value – thus, using the actual export price of $95 as per our example, $8 would be collected, being the difference between the average home market price of $103 as determined in the prior investigation, and the actual export price of $95 (“the floor price method”).

As evidenced by the application of these collection methods to the situation we have described, the different ways in which the Minister can choose to “tax” importers when they import products subject to dumping duties give different results when applied to the same actual export price ($95):

- combination and floor price methods – $8; and

- ad valorem method – $2.85.

This variability itself, and how the Minister decides which method to apply in any particular case, are problematic topics of their own. The topic of this newsletter, however, is the addition of another layer of discretion, applicable to the circumstance in which an exporter requests a review of the dumping duty imposed on its exports. If passed, the new laws will allow the Minister not only to choose the method of collecting the duty, but also the amount of the export price that will be ascribed to the exporter.

And this is where things get tricky.

Political choices collide with the rule of law

Costs and prices change over time. Any seller, motivated by profit considerations, will want to adjust its selling behaviour to take advantage of these changes, and of any efficiencies and innovations it has enjoyed, to increase its profitability. Competition between sellers and bargaining between sellers and buyers will strike a price at which sellers either make a profit or go out of business.

Dumping is an economic condition caused by world price trends, over-supply and input cost variations. It can come about through the divergence of prices in individual country markets, or even by a conscious decision by an exporter to recover only its variable costs on export sales when its home market sales have already recovered its fixed costs. Dumping duties equalise an export price with its home market price, such that an Australian industry that establishes that it has been materially injured by dumping can later compete with an imported product at a “fair” price and not a “dumped” one.

The implementation and application of anti-dumping laws – in accordance with the WTO Anti-Dumping Agreement – creates one rule for exporters and a different rule for domestic industry. Imported products can be “taxed” so that any price or cost differential between their export price and their home market price is equalised. Australian-made products can’t be taxed in this way, no matter whether their prices are differentiated between regions of Australia, or are below cost.3

Taxing importers protects the Australian industries that foreign exporters and local importers compete with. Higher tax, more protection. The perspective of exporters and importers is that they should be able to compete in the Australian market. Probably, Australian industry would prefer that they didn’t. As the policy referee of this debate, and using its sovereign power, the Australian government can do what it likes. That, however, does not dispense with the requirement to comply with law, and the implications of not doing so, which is a question to which we now turn.

How does the new law work?

The proposed new laws say that if an exporter comes forward and asks for a review of the dumping duty applicable to its exports,4 the Minister may still use the combination method but does not have to use either the exporter’s contemporaneous export price, or indeed its export price at all, in setting the dumping duty payable. Instead, the Minister may decide that the export price for the exporter should be:

- its previous average export price, being the one ascertained in the original investigation (i.e., no change);

- its average export prices to third countries; or

- the average export price of any other exporter from the same country as the exporter requesting the review, as long as the Minister’s decision about that export price took place sometime in the last two years before the review was initiated.

This discretion is to apply if the exporter had no exports in the recent period – the period used to undertake the review – or if it had what the Minster considers to have been a low volume of exports in that period, There is no ceiling that defines a low volume, no statutory hierarchy to these choices, and no guidance as to which might be considered to be appropriate in any particular case.

As explained above, dumping occurs when an exporter’s price of goods destined for Australia is less than its home market price, and that causes material injury to an Australian industry producing the same goods. The proposed new law has the potential to divorce an export price finding from contemporaneous fact, and does not even require the export price to be that of the exporter that requested the review.

Not really getting a review – what the numbers could look like

What does this mean for exporters whose products are subject to dumping duties, and the importers who have to pay the duties?

To answer that question let’s return to our example. Assume the exporter in our example had been unable to export to Australia, or had much lower export volumes, since the dumping duties were imposed. These are typical and even expected scenarios – there is nothing about the imposition of dumping duties which is intended to encourage continued exports at then prevailing prices. If economic conditions cause costs and prices to go down, the combination method requires importers to pay even more duty as the gap between the outdated average export price and lower market prices increases. Paradoxically, the importer has to pay higher duties even though the “normal value” is going down.

So, let’s say an exporter comes forward for a review, arguing that its home market price (the basis for its normal value) has gone down from $103, as it was in the investigation used in our example, to say $93. Let’s also assume that, applying the new law, the Minster does not change the average export price from that which applied previously. The values that would be worked out in the review would be $93 as the normal value (the home market price) and $100 as the export price (a continuation of the old export price).

Using those numbers, the exporter is not dumping, because its export price ($100) is more than its home market price ($93). That’s got to be a good thing for the exporter, right?

Not exactly. As a result of this review, dumping duty would still be payable by the importer, even if it were to import at an actual export price of $93. Although the first amount of combination method duty would be zero, because the percentage dumping margin would itself be 0% as a result of the review, the second amount that makes up the combination method duty would blow out considerably. Recalling that the second amount is the amount by which the actual export price (which we have assumed to be $93) is less than the average export price worked out in the review, which was not changed from before ($100), the dumping duty will be $7.

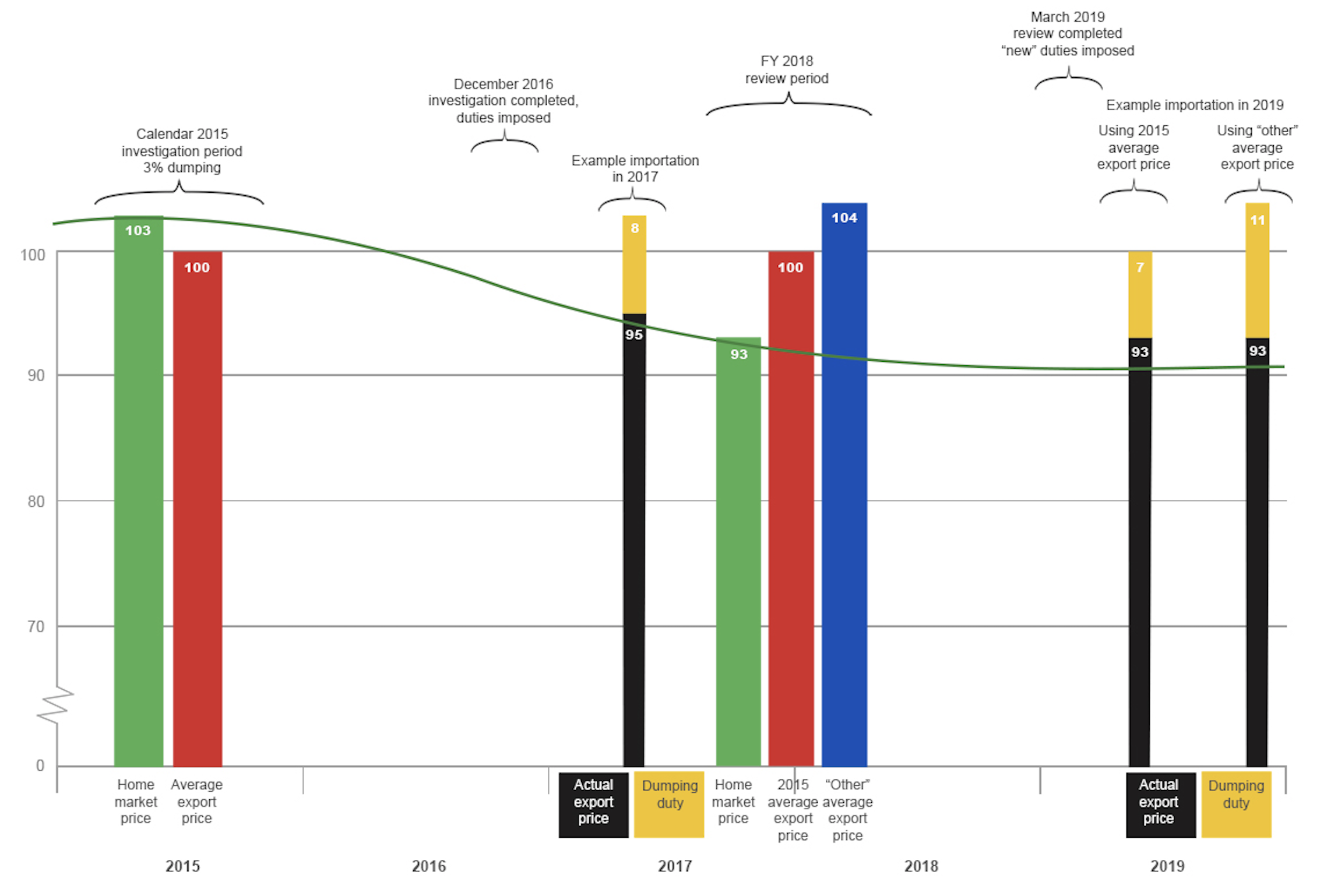

These are difficult concepts to get your head around. Perhaps, a picture will help:

Here we see:

- an investigation using calendar 2015 as the period to determine dumping, that concluded in December 2016 with a finding of a dumping margin of 3% and an average export price of $100;

- an example importation in 2017 in respect of which the combination method collects $8 in dumping duty;

- a review using FY2018 as the period to determine contemporary dumping, that concludes in March 2019 with a finding of a lower home market price (normal value) for the exporter, but in which there were no exports by the exporter or in which the Minister rejects the exporter’s own exports as being of a “low volume”; and

- example importations in 2019, one of which assumes that the Minister did not change the exporter’s average export price from that which applied in 2015, and the other which assumes that the Minister used an “other” exporter’s average export price for that purpose.

In our example, the contemporaneous home market price in FY2018 was $93, meaning that $93 would not be a dumped export price. The way in which the combination method works in the not-unusual fact scenario we have contemplated is to require an importer to pay, on example importations in 2019:

- a dumping duty of $7 in a case where the Minister decided not to change the export price of the exporter from that which applied four years previously; or

- a dumping duty of $11 in a case where the Minister increased the average export price because an “other” exporter enjoyed a higher export price in FY2018.

These duties amount to a tax on importers of 8% and 12% respectively when, based on more recent FY2018 data, the products are not “dumped” at all and no duty should have been paid.

Dumping duties, when there is no dumping

Is this a mistake? No, not so far as our explanation is concerned. Then surely the example is only one of a range of things that might happen? Yes, it is true that there might be other outcomes. The Minister might choose to replace the combination method with the floor price method, which would lead to the collection of dumping duty only where actual export prices go below the normal value, or could maintain the combination method but choose an export price that is lower than the one that caused the Minister to impose the dumping duties in the first place.

However, the rhetoric around the amendments suggests that benevolence towards exporters is not contemplated. The Minister for Industry, Innovation and Science, the Hon Craig Laundy MP said, when introducing the Bill in Parliament:

Currently, there exists the possibility that foreign exporters subject to duties can subvert the review of measures process to undermine the remedial effects of Australia’s anti-dumping system. Foreign exporters are able to deliberately limit exports of the dutiable goods for a period of time in order to obtain a more favourable rate of duties for future exports. This facilitates the opportunity for exporters to resume dumping and continue to injure Australian industry.

Australian industry will be pleased by this sentiment. Exporters will be upset. They will contend that the same principles that make up a decision whether to impose dumping duties at all ought also to be applied in the case of a review. Understandably, they will be troubled by way they have been demonised, as evident in the Minister’s statement and in other statements by politicians and public officials in a number of fora over recent years. Economists will be opposed, as they always are, viewing dumping as an economic phenomenon which is part and parcel of a rational market system. They will decry the competitive disruptions and the inefficiencies that high price barriers will cause for the domestic industries that rely on imported products and for Australian consumers.

The combination method, contemporaneity and WTO norms

And what about the lawyers – what will their view be of all this?

One of the main “faults” of the combination method is that it is best suited to a situation where there is a dumping margin, and not where there isn’t. The second amount that makes up combination method dumping duty captures the amount by which the actual export price is less than the previously “dumped” export price. But if the actual export price is not dumped, based on a more recent normal value, then why should dumping duty be collected in excess of the more recent normal value? Another duty collection method – the floor price method – does exactly that.5

Indeed, the drafting of what is now known as the combination method, when it was first introduced in 1993, was probably focused only on the imposition and collection of dumping duty at the end of an original investigation when dumping had been found. Ipso facto, in that scenario, the export price had been found to be less than the normal value, and it made sense to collect additional dumping duty if actual export prices went even lower. If that was the original drafting intention, then the proposed new laws are built on a shaky foundation indeed – a kind of “happy fluke” so far as Australian industry is concerned.

When market conditions change, such that there is no dumping, or less dumping, it is not clear why importers should continue to pay duties which are not based on current prices and costs and which, as a result, are much higher than they should be. As the example presented in this article shows, exporters and importers will be penalised, and trade and competition will be degraded, in the application of a duty collection system that maintains high barriers to entry. This is the prospect of the proposed new laws.

Australia can only implement and apply an anti-dumping regime in accordance with its rights and obligations as a WTO member under the WTO Anti-Dumping Agreement. Our trading partners – pressured by their own domestic industries – will be forced to run their WTO slide rule over the new laws. They can be expected to be concerned as to whether the proposed new laws, or any application of them, comply with:

- the fair comparison obligation of Article 2.4, which requires export price and normal value to be compared in respect of sales made at as nearly as possible the same time;

- the obligation to determine an individual margin of dumping for an exporter under Article 6.10;

- the obligation to collect dumping duty in appropriate amounts, and on a non-discriminatory basis, under Article 9.2;

- the requirement under the Article 9.3 chapeau that the amount of dumping duty not exceed the margin of dumping, and whether, and to what degree, dumping duty refund systems of the kind described in the sub-articles of Article 9.3 can justify any “over-collection” of dumping duty at the time of importation; and

- the obligation of investigating authorities to take into account information submitted by an exporter where that information is verifiable and appropriately submitted, as per paragraph 3 of Annex II.

Trade law compliance and strategy never more critical

Domestic industries have successfully lobbied policy makers, and have strongly argued their case with the Anti-Dumping Commission, for ever-more stringent “protection” from dumping. Anti-dumping – overseen by Australian governments that have thin parliamentary margins and short electoral cycles – is the only tariff remedy available to domestic industry in an increasingly fractious international trading environment.

Anti-dumping’s political popularity reflects these present-day realities. How its application stacks up in legal terms is a question that is being asked more frequently.

Moulis Legal’s trade regulatory team handles WTO-related matters, export and import compliance, trade sanctions, and cross-border commercial arrangements. For more information please contact Daniel Moulis on +61 2 6163 1000 (daniel.moulis@moulislegal.com).

This memo presents an overview and commentary of the subject matter. It is not provided in the context of a solicitor-client relationship and no duty of care is assumed or accepted. It does not constitute legal advice.

© Moulis Legal 2017

[1] If the actual export price is more than the average export price in the prior investigation, 3% of that higher actual export price would be collected as dumping duty, and no more.

[2] See footnote 1.

[3] Exceptionally, Section 46 of the Competition and Consumer Act 2010 creates offences and liabilities in cases where a corporation with a substantial degree of power in a market takes advantage of that power for the purposes of eliminating or damaging a competitor. Sustained below-cost pricing is specifically referenced in that Section. An effects-based test is to be included in Section 46, as an alternative to the present purpose-based test, when companion legislation to the amending Act itself comes into force.

[4] Reviews of exporters’ prices can also be requested by Australian industry, or self-initiated by the Minister.

[5] The ad valorem system has its own flaw, in that when actual export prices do increase, suggesting that there is no dumping or less dumping, the amount of dumping duty goes up (because it is a fixed percentage of a higher amount).

Liked this article? You may also like trade mark registration